[av_content_slider heading=” columns=’1′ animation=’slide’ navigation=’arrows’ autoplay=’false’ interval=’5′ font_color=” color=”]

[av_content_slide title=” link=” linktarget=”]

[/av_content_slide]

[av_content_slide title=” link=” linktarget=”]

[/av_content_slide]

[av_content_slide title=” link=” linktarget=”]

[/av_content_slide]

[av_content_slide title=” link=” linktarget=”]

[/av_content_slide]

[av_content_slide title=” link=” linktarget=”]

[/av_content_slide]

[av_content_slide title=” link=” linktarget=”]

[/av_content_slide]

[av_content_slide title=” link=” linktarget=”]

[/av_content_slide]

[av_content_slide title=” link=” linktarget=”]

[/av_content_slide]

[av_content_slide title=” link=” linktarget=”]

[/av_content_slide]

[av_content_slide title=” link=” linktarget=”]

[/av_content_slide]

[av_content_slide title=” link=” linktarget=”]

[/av_content_slide]

[av_content_slide title=” link=” linktarget=”]

[/av_content_slide]

[av_content_slide title=” link=” linktarget=”]

[/av_content_slide]

[/av_content_slider]

[av_textblock size=” font_color=” color=” av-medium-font-size=” av-small-font-size=” av-mini-font-size=” admin_preview_bg=”]

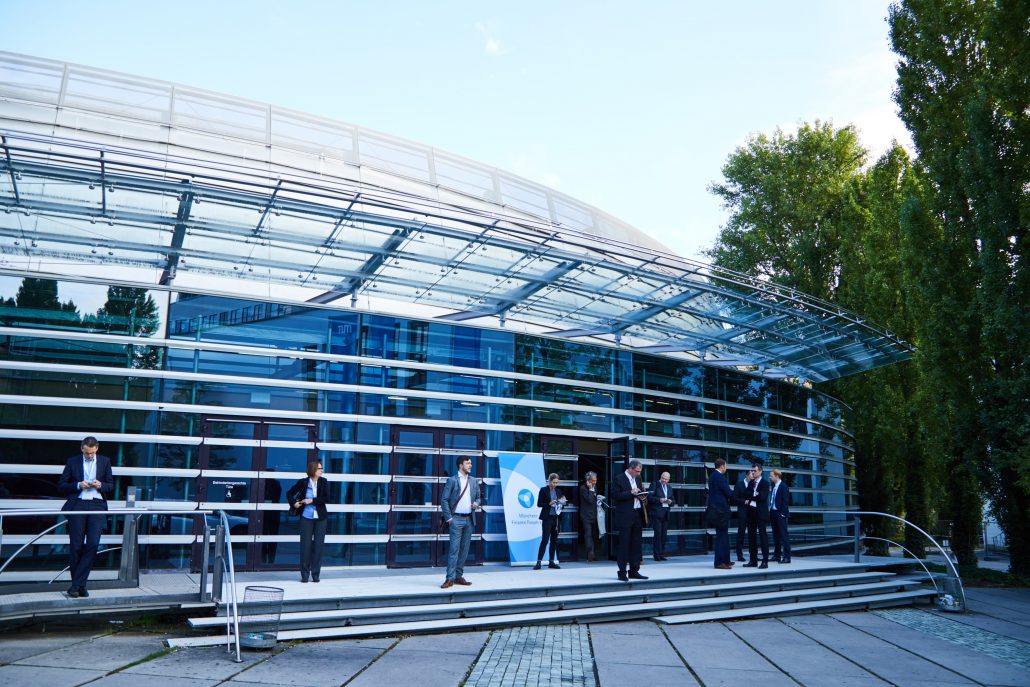

On September 11, 2017, the Münchner Finance Forum e.V. hosted its 13th Annual Conference at the AudiMax of the TUM. The subject of the conference was “Return production and risk management in an ambitious environment”. Despite school holidays in Bavaria 409 guests took the time to discuss with five speakers at the event.

Dr. Thomas Hartmann, CEO of GBW (PLC), about “Commercial Real Estate as Asset Class”, held the first lecture. Residential property differs from other products in that the customer has to come to the product. Therefore, demography is an essential value driver for demand. In Germany, there are large migration movements between East and West, as well as between town and country. Furthermore, there is an increasing consumption of living space through growth in single household numbers. The debt crisis of the Eurozone has brought circa 1,000,000 migrants from Europe in 2009, for whom no living space was planned earlier. Moreover additional regulatory requirements until 2009 had led to decreasing permits for apartments. Today fewer apartments are approved Germany-wide, than would be needed in Berlin alone. Additionally it is not certain, whether increasing interest rates reduce demand. Almost 80% of all apartments belong to private individuals. 43% of those are owner-occupiers; another 37% of apartments are bought as an investment. Professional vendors are in the minority. Since many private individuals acquire real estate through long-term loans, they have an implied protection against an increase in interest rates because of fixed cashflows. In addition, private individuals attach emotions to real estate. That is why prices do not necessarily have to fall because of interest rate increase. Moreover, realty as a product changes heavily through digitization, which brings new sales possibilities for commercial providers.

Subsequently Prof. Dr. Manfred Schwaiger, dean of studies at the institute of market-based management of the LMU Munich, spoke on the topic “Corporate reputation, financial performance and corporate risk”. He was able to show that the share of “Intangible Assets” concerning market value of real estate has increased strongly since 1980. Book value decreases relatively speaking during assessment. The difference can be interpreted as reputation. Through surveys, which are regularly conducted by market research companies at all stakeholders of a corporation and are commissioned by his institute, one can determine a reputation value. This reputation value can be used in Asset Pricing models like Fama/French (1993) as another variable. Hereby reputation during investment processes can be quantitatively considered. With the help of exemplary calculations, Prof. Schwaiger was able to show that a portfolio made up of reputation leaders (Top 25%) beat the DAX-Index during a five-year-period by 28%.

Dr. Claus Stickler, CEO of Allianz Investment Management SE, held the third lecture about “Investment management in a global context”. The AIM SE administers 650 billion euros equity capital of the Allianz, as well as 120 billion euros from unit-linked life insurances, with the help of 500 experts in six regional hubs.

Dr. Stickler illustrated the global matrix-organization of the Allianz, which presets a clear process for the complete value chain of Asset Liability Management, through investment strategy, managerial selection, respectively Asset Management up to investment monitoring. A portfolio of this size requires clean analyses and consistent implementation. This often leads to conflicts of objective between regions and functions, which always have to be solved with regard to customer value. Due to low interest rates and strict regulation develops strong cost pressure, which leads to pooling of services beyond company boundaries. All services, which are not relevant to competition, can be offered to other insurers for refinancing. Digitization offers additional opportunities for automation and distribution.

The fourth speaker Prof. Dr. Thomas Hartung, chair of insurance industry studies at University of Bundeswehr, Munich, showed a scientific perspective on “False incentives in Asset Management through Solvency II”. The new guidelines are expected to drive the capital investment of 9,8 trillion euros in Europe and 1,5 trillion euros of it in Germany. Prof. Hartung illustrated, that Solvency II does not correlate with “real” respectively, desired risk. Capital life insurers (circa 60% of all assets) are able to economically plan more long-term than property insurers who need large liquidity short-term. Short-term models often with one-year-horizons overestimate capital market risks, because chargeback over time is not factored in. In addition, the diversification calculation about standard distribution is disputed. Furthermore, orientation to short-term market value undermines incentives to illiquid assets in long-term asset classes like stocks, real estate, infrastructure or securitization.

Last speaker of the day was Dr. Martin Lück, Chief Investment Strategist at BlackRock, who gave a current market outlook. For the first time since the financial crisis, a worldwide-synchronized growth can be observed in the most important economic zones, even though it happens on a low growth trajectory. Reflation continues, however inflation hardly increases in the Eurozone and in Japan. Technological progress has a dampening effect. Due to digitization, prices can hardly be raised, because in many sectors this causes pressure on corporations. BlackRock estimates the economic development of the G7-countries and expects that the 12-consensus prognosis will be surpassed. Interest rates will remain structurally low, which is why a fresh look at assessments is needed. Against this background, stocks seem relatively low-priced. Low volatility is no reason for concern, because 80% of the time volatility is low. At the same time political risks increase.

The 14th Annual Conference of the Munich Finance Forum e.V. will take place on September 18, 2018 at the AudiMax of the Technical University of Munich.

[/av_textblock]