- Company, Events

Conference of the Munich Finance Forum

After a gap of two years, we are particularly pleased to finally be able to hold our 18th Annual Conference of the Munich Finance Forum in person again this autumn. On September 14th, about 400 guests from the financial sector will congregate to network and exchange information. This year, the association will once again present top-class speakers such as Dr. Jens Ehrhardt from DJE or Klaus Wiener Member of the German Bundestag to address and discuss exciting current topics and questions from business, politics and the world of finance.

Your chance to participate in discussions on the latest developments and perspectives from esteemed guests and to engage in live discussions with eminent speakers and the financial community.

For more information visit our website:

- Company, Events

DKF GOES OKTOBERFEST

DKF goes Oktoberfest: This year the DKF Oktoberfest will be held for the first time on September 22nd, 2022. About 200 handpicked guests from the financial industry will come together for a special kind of networking. In a typical Bavarian atmosphere inside the Schützen Festzelt tents on the Theresienwiese, interesting topics from the areas of ESG, funds, market data, energy and geopolitics, digital assets, and many more will be intensively discussed at the various topic tables with selected table captains. We look forward to this special networking event.

For more information visit our website:

- Products

More Than 1300 Guests At The 11th DKF

The 11th DKF Congress on Financial Information was held as an online event from May 4-6. Over 1300 visitors saw 50 presentations and panel discussions on current topics in the financial information industry. In addition, there was a virtual trade show event with over 30 vendors, each of whom was able to showcase their products at a virtual booth.

Originally, the event was established for the German-speaking region. It grew to become the largest financial information congress in the world with 1000 visitors. The event ban during Corona was an opportunity for us because we could also welcome guests from Asia and America at the digital format.

Among other things, the strategy of the London Stock Exchange in the acquisition of Refinitiv was presented. Several presentations were dedicated to the topic of sustainability. The so-called ESG (Economic, Social, Governmental) data is a great impetus for providers because the entire financial industry is strongly aligned with it.

We would like to thank all sponsors and guests and are already looking forward to next year, where we will hopefully meet again in person. However, we will keep the digital format and thus continue to grow the community.

- Products

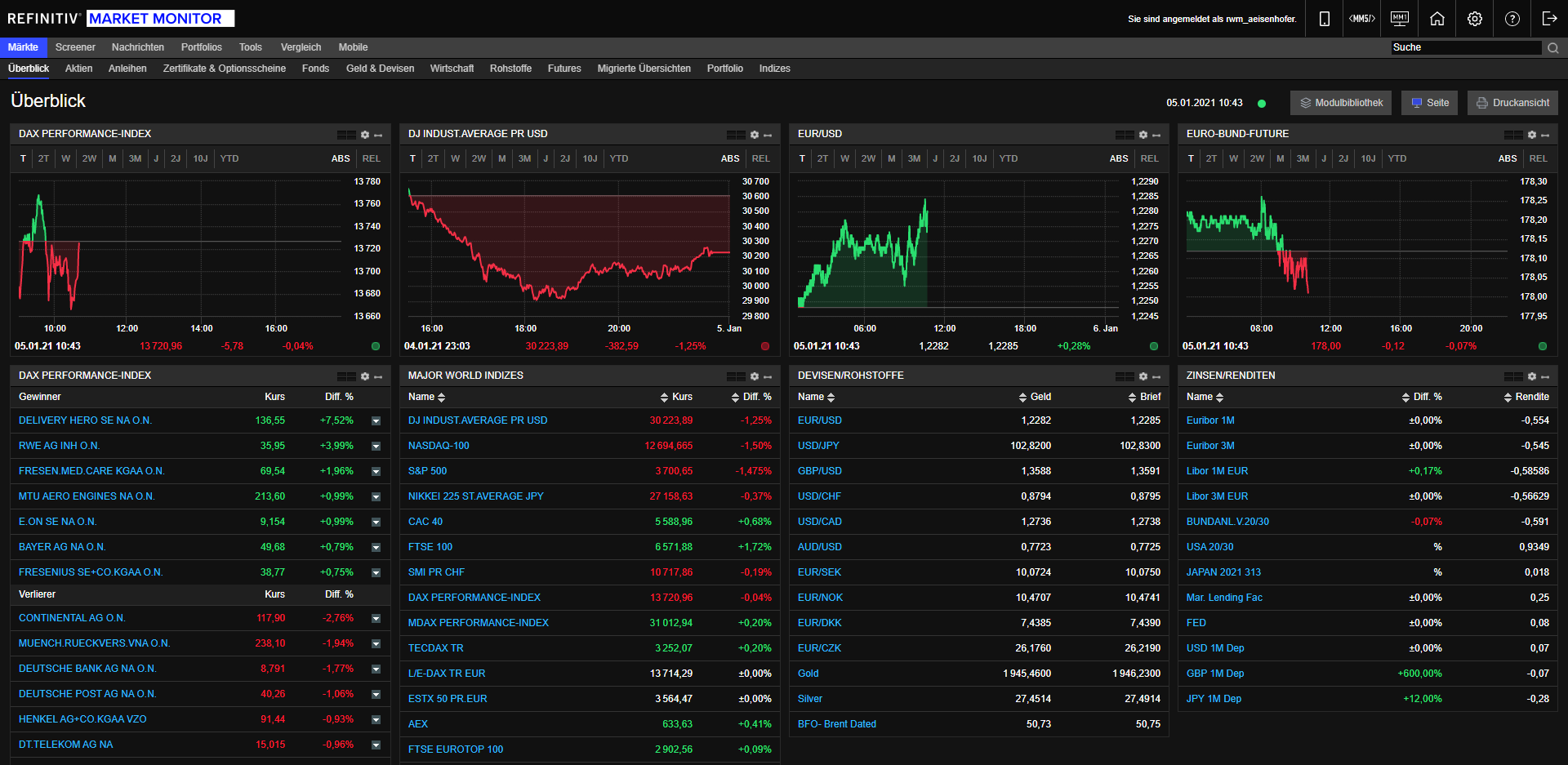

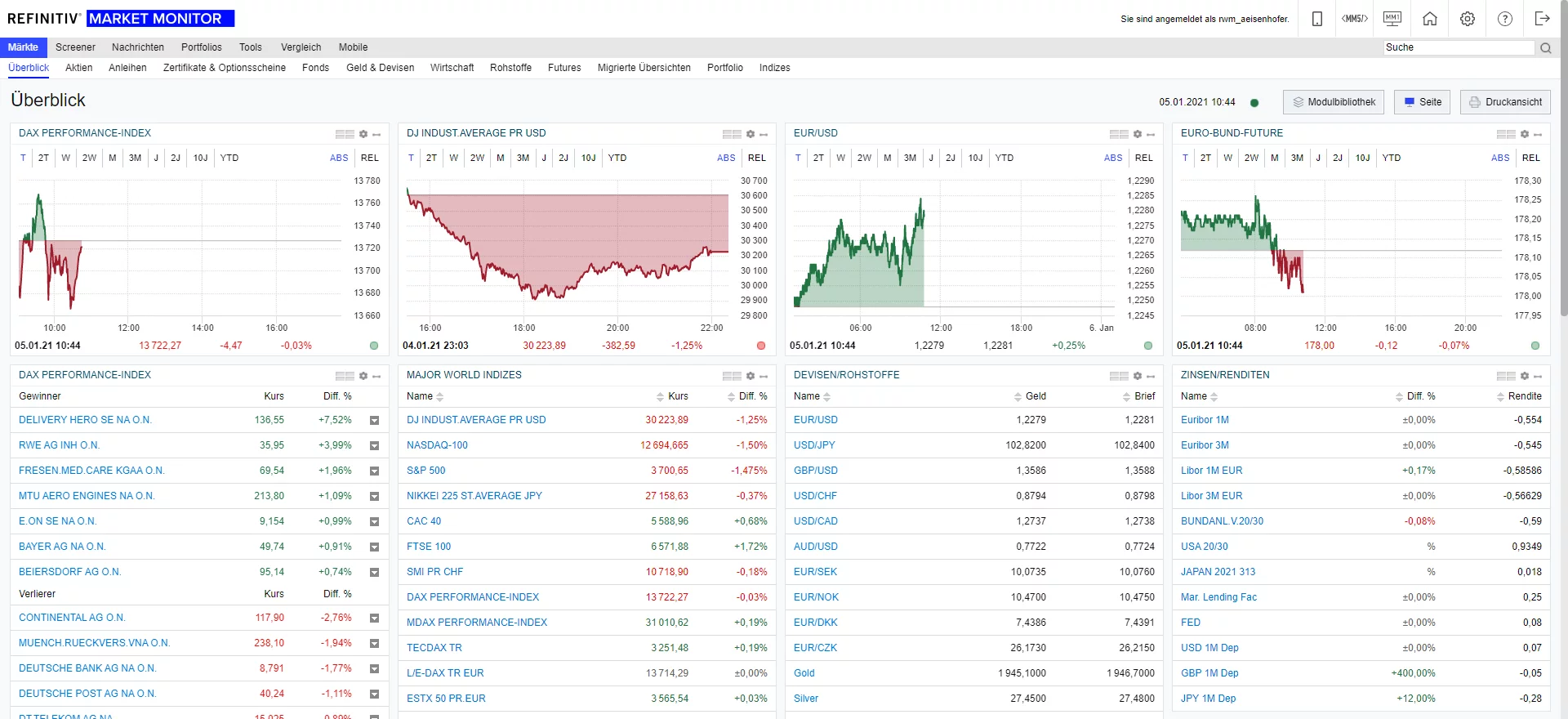

New version of Refinitiv Market Monitor available

The former wealth management applications Thomson Reuters Knowledge Direct Professional (TRKD Pro) and Thomson Reuters Wealth Manager Germany (TRWMG) are now Refinitiv Market Monitor.

Refinitiv Market Monitor is completely redesigned and the user can decide between two skins: a sophisticated dark skin and a fresh looking white skin.

The application can be accessed via the URL Https://Marketmonitor.Refinitiv.Com.

Admin notice for:

Content Slider

This element was disabled in your theme settings. You can activate it here:

Performance Settings

- Company

Update To The Coronavirus

On Monday the Dow Jones Index lost almost 3000 points (- 13%), the largest absolute loss in history since 1871. The fear of the spread of the coronavirus is the biggest shock to the economy in peacetime. What does the situation mean for our customers and our employees?

Access to our systems is extremely high at the moment, as is trading volume on the stock exchanges. Accordingly, there are many more updates than in normal times. In these extreme times it is very important that our customers receive new prices, analyses and news. In times of great stress for our users we want to be a reliable partner who supports them in the best possible way.

In addition to the technical challenges, there is currently a great deal of uncertainty for the entire economy. Global supply chains are interrupted and companies are getting into difficulties. Thanks to our excellent customers and recurring revenues, we are in a very robust position. We have no debts and have always built our business in a very sustainable way. That is why we are a reliable partner and will always give the best for our customers.

All our employees already work from home. There is no danger of all employees being infected with the coronavirus at the same time. We wish you and your families health and confidence!

- Survey

What will the stock market year 2020 be like?

From 9 to 13 January, we sent a New Year’s survey on capital market expectations in 2020 to finance professionals who are on the distribution list of our events at MehrWertpapiere.De. As of the reporting date, 846 participants have cast their votes, which is why significant statements are already available. We are very proud that 24.9% of the recipients decided to participate in the study. This speaks for great interest. At this point, we would like to thank each and every participant!

Unfortunately the results are only available in German, however most results are self-explanatory.

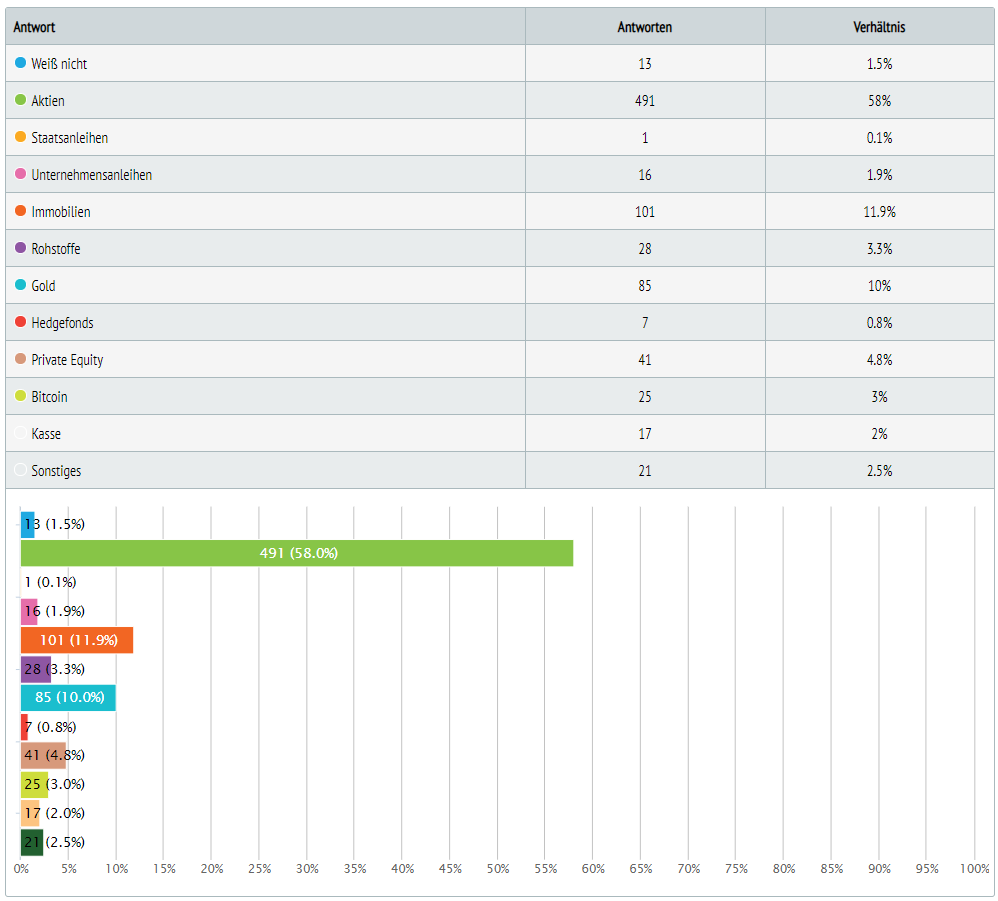

Question 1: Which asset class is your favorite?

At 58%, equities are in first place among the majority of participants, followed by real estate with just under 12%. In times of zero interest rates, no further price potential is seen for bonds, which would only be realised if interest rates were to become even more negative. This means that tangible assets are still the most in demand. This is also in line with the portfolio breakdown that we determined in the next question.

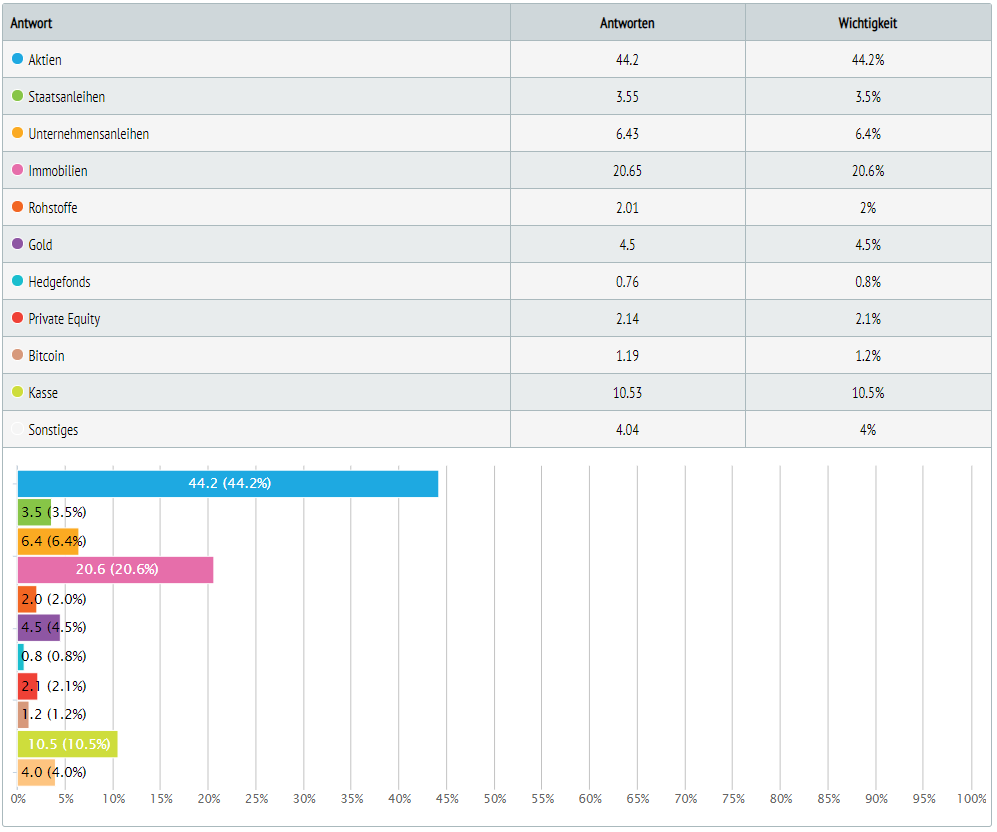

Question 2: How is your portfolio divided?

At just under 44%, equities are the most important component in the private portfolios of finance professionals. In my view, this is particularly remarkable because the financial sector often holds much lower equity quotas for its clients for regulatory reasons. In the survey of institutional investors on investment behaviour in 2018 conducted by the Scope analysis company, institutional investors accounted for only 5% of equities. Real estate followed in second place with 21% portfolio share. The financial professionals therefore prefer tangible assets themselves. Interestingly, Bitcoins have a share of 1.2%. However, only 76 of 846 participants have Bitcoins in their portfolio. Among these investors the Bitcoin share is 13.2%.

Question 3: What do you think will be the winning region in 2020?

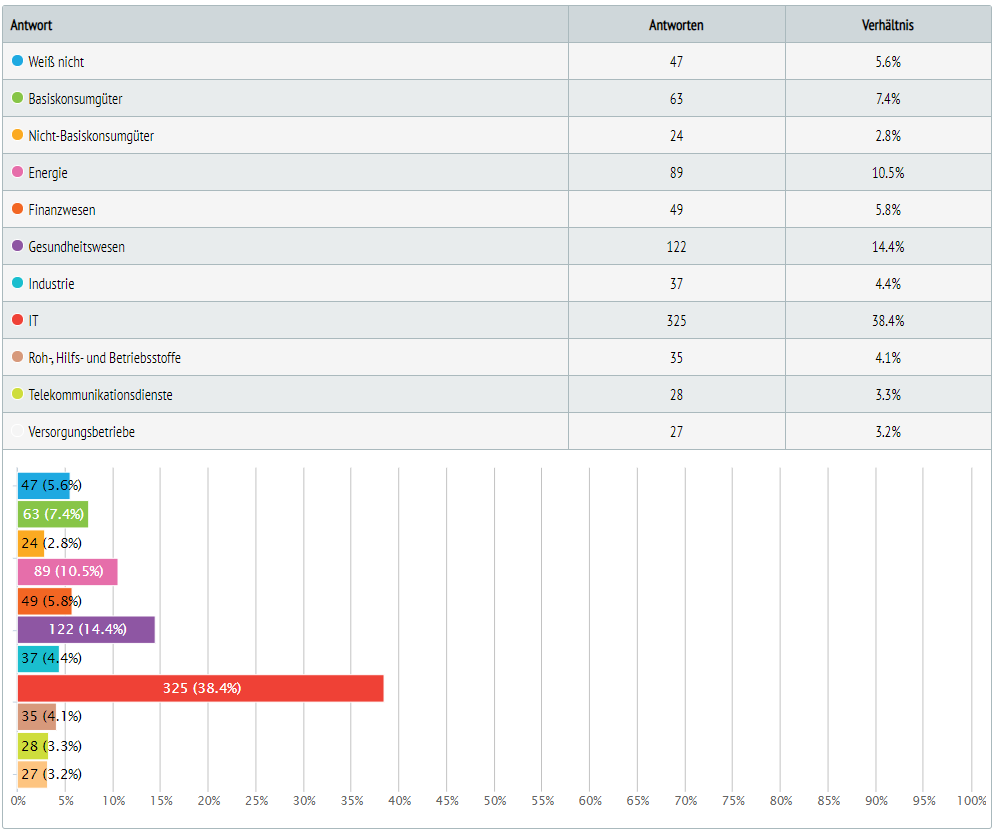

Question 4: Which industrial sector is your favourite for 2020?

Question 5: Top share – Which DAX stock will win in 2020?

Question 6: Flop stock – Which DAX stock will lose in 2020?

With the exception of Fresenius, every DAX share is on both the top and the flop list. In terms of net positions, SAP is in first place (Top 115, Flop 2). Wirecard follows (Top: 167, Flop: 107) ahead of Fresenius Medical Care (Top: 45, Flop: 1). Deutsche Bank (Top: 39, Flop: 214) is at the bottom of the list, ahead of Lufthansa (Top: 5, Flop: 61) and Volkswagen (Top: 14, Flop: 63).

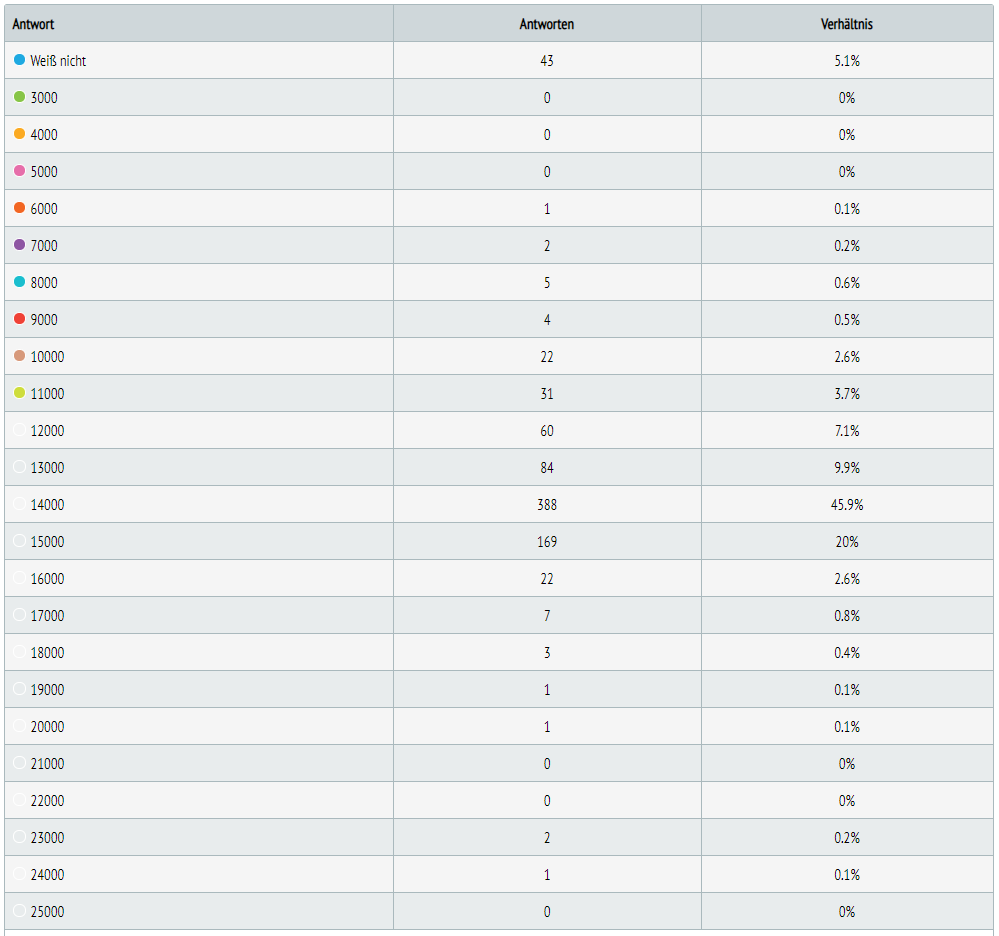

Question 7: Where does the DAX stand on 31.12.2020?

On average, the survey participants expect a DAX price of 13,786 at the end of 2020, which is a moderate increase of 2.7% compared to the closing price of 2019. After the large gains in equities last year, many investors are obviously more cautious. It seems somewhat incomprehensible why 58% of those surveyed see shares as the best asset class and then estimate only this value for the DAX.

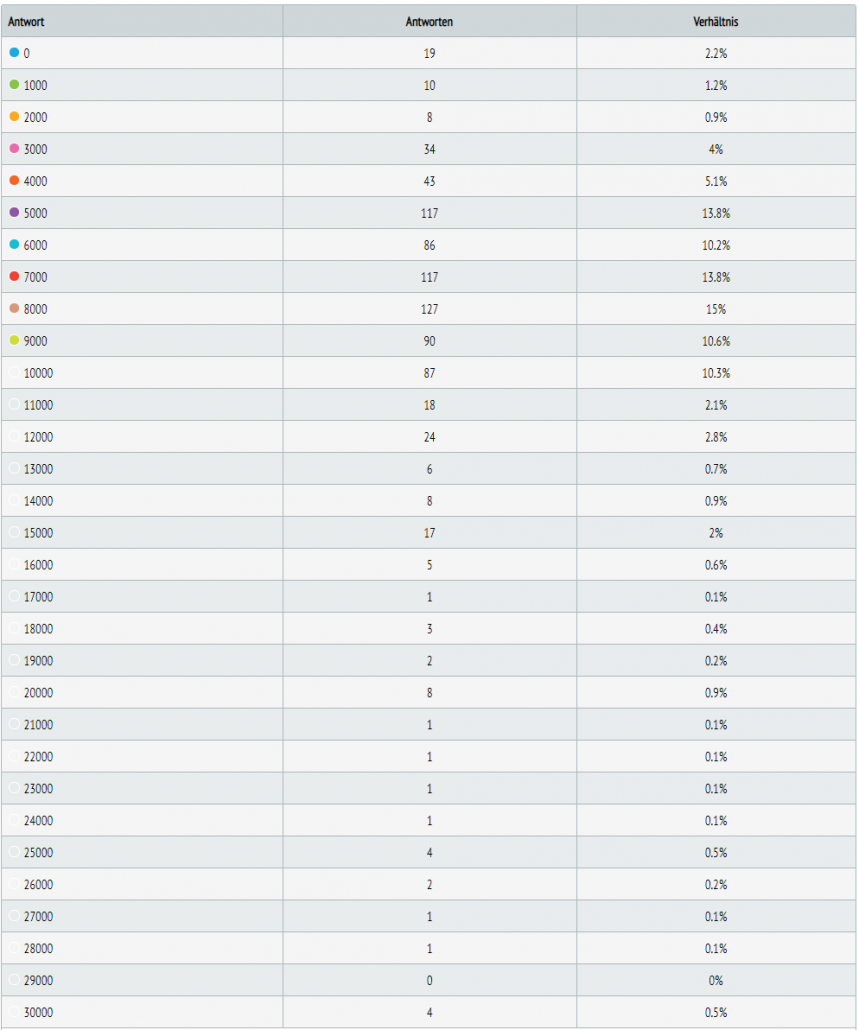

Question 8: Where does the Bitcoin in USD stand on 31.12.2020?

The survey participants expect an average Bitcoin price of USD 7,817 at the end of 2020, an increase of 8.5% compared to 2019. Although on average Bitcoins have a higher return expectation than equities, equities dominate the question of the best asset class with 58%. Perhaps this inconsistency can be explained by looking more closely at the data. If you differentiate the question and look only at the 76 investors who actually have Bitcoins in their portfolio, you will find a much higher expectation. On average, a Bitcoin price of USD 13,779 is expected in this target group (+76%). Perhaps the strong return expectations of Bitcoin fans thus distort the overall picture.

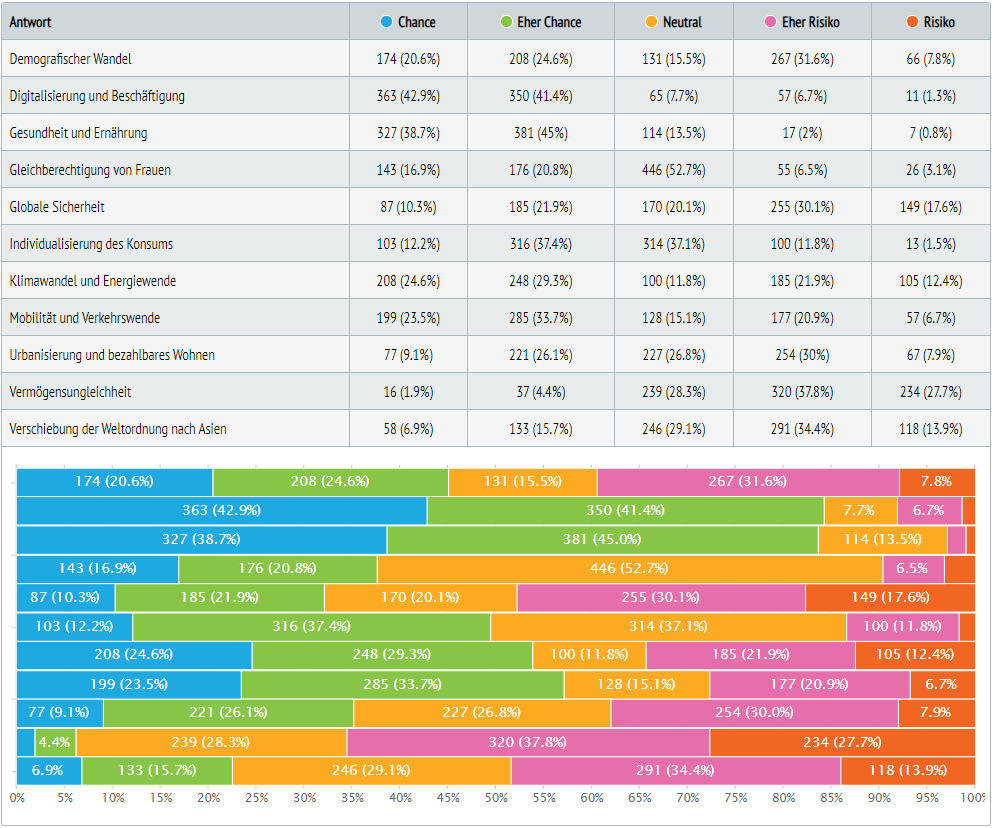

Question 9: Do you personally see opportunities or risks in the following megatrends?

Participants see the greatest opportunities for themselves personally in the area of health and nutrition, just ahead of the topic of digitisation and employment. I find it remarkable that there is obviously no fear of robots or disintermediation in the financial sector. Almost equally important are the individualisation of consumption, mobility and transport and also equal rights for women. We are very pleased that equal rights for women are seen as an opportunity in the financial sector, where one woman is confronted with 17 men in the executive suite. The greatest risks are seen in the area of wealth inequality. According to this, people are very concerned about the shift of the world order to Asia and global security.

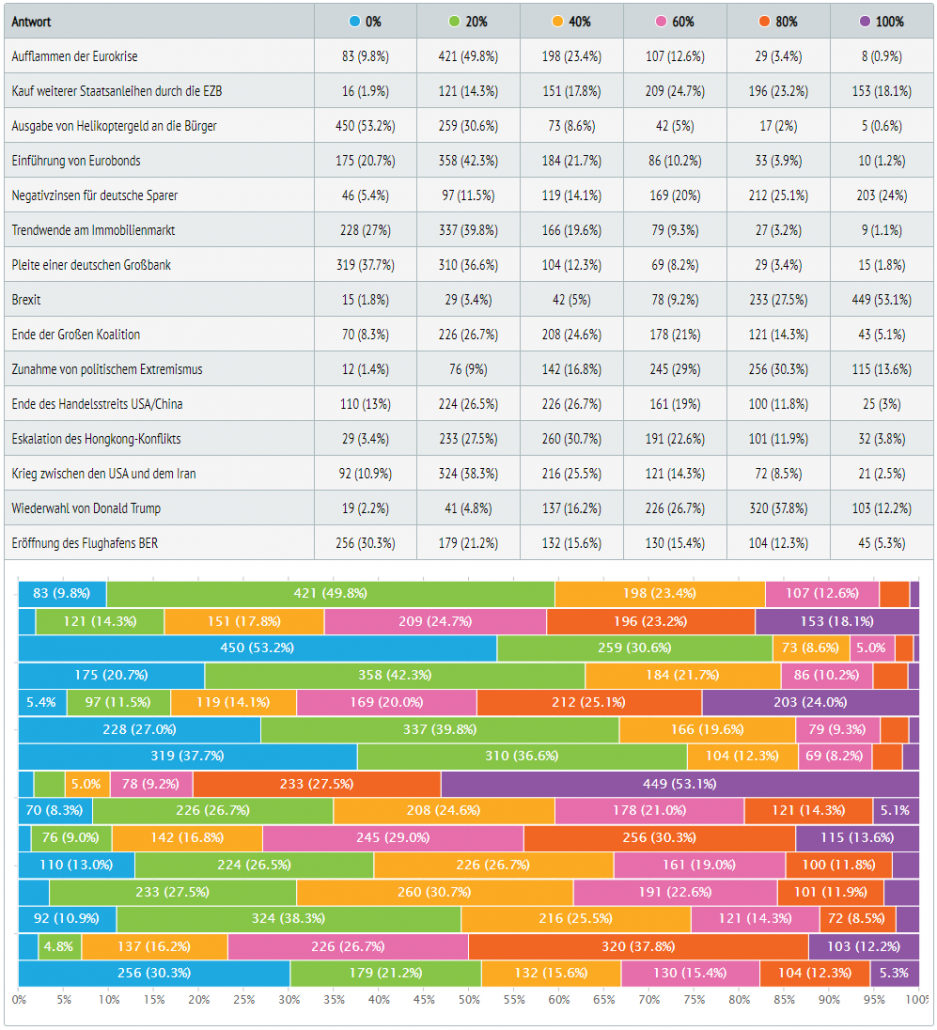

Question 10: What probability do you give the following events in 2020?

With an average of 83%, Brexit is most strongly expected by the capital market. First of all, the re-election of Donald Trump is expected immediately afterwards, with an average of 66%. The US stock market has risen by almost +60% since his election in 2016, which is perhaps why financial professionals are thinking particularly positively here. Negative interest rates of 64% are expected for German savers. At 15%, the ECB’s issuing of helicopter money to citizens seems particularly unlikely today, followed by the bankruptcy of a major German bank (22%). A trend reversal on the real estate market is also rather unlikely from the participants’ point of view, at 25% on average.